Trump Tariffs Escalate, Placing Indian Stock Market on Edge

MUMBAI, India – August 7, 2025: The Indian stock market is getting ready for a possible drop after the U.S. government said it’s putting a new 25% tariff on Indian imports, bringing the total up to 50%. This is punishment for India still buying Russian crude oil. It’s scared businesses that export stuff and is likely to make things unstable for a bit. A big market crash isn’t a sure thing yet, but experts say we might see a quick 1-2% drop, and India’s GDP could take a bigger hit if the tariffs stick around.

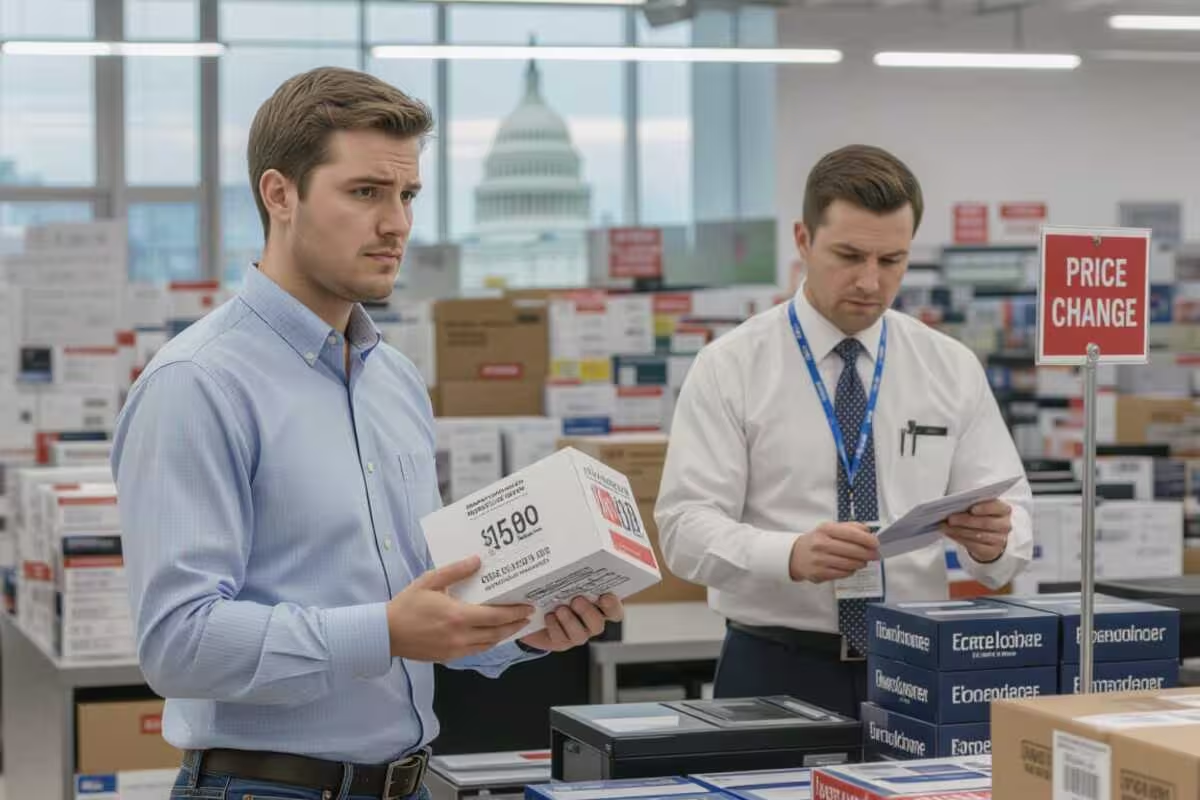

The Tariff and What It Means Right Away

The U.S. order adds another 25% tax on top of the 25% tariff that started today, August 7, 2025. The new tax kicks in on August 27, 2025, making it a total of 50% on many Indian products.

This makes India and Brazil the countries with the highest taxes from the U.S. The rate is way higher than the 30% in China, which puts Indian exporters in a tough spot.

What Analysts and Experts Are Saying

Analysts think the Indian stock market is in for a rough time. Dhiraj Relli, MD, & CEO of HDFC Securities, thinks the market might drop 1-2% at first but hopes they can sort things out with talks.

But other experts aren’t so sure. Seshadri Sen, Head of Research at Emkay Global Financial Services Ltd., says to be careful but ready to jump on opportunities when investing. He says if the market drops more than 5%, investors should buy the dip because it shouldn’t hurt the earnings of listed companies that much.

Which Businesses Are in Trouble?

Businesses that export a lot are in danger. The Federation of Indian Export Organisations (FIEO) says over 55% of India’s exports to the U.S. could be affected.

The most at-risk industries are textiles, leather, engineering goods, and gems and jewelry. An FIEO director general says many export orders are already on hold, and small businesses with low profits might not be able to handle the sudden extra cost.

What It Means for the Economy in the Long Run

If the tariffs stay for a year, experts say it will really hurt India’s economy. HDFC Bank thinks it could knock 0.4-0.5% off GDP, which might make them lower their growth prediction for FY26 to under 6%.

But some experts think India’s strong domestic demand and self-contained economy will cushion the impact. The government isn’t planning any direct handouts but is looking at ways to help exporters, like making loans easier and cutting red tape.

What’s Next?

The 21-day wait before the new tariff starts gives them time to talk. Indian and U.S. trade teams are expected to meet and try to find a solution.

But President Trump’s unclear position on a ceasefire in Ukraine and how it might be connected to the tariffs on India makes things uncertain. The market will be watching closely for any diplomatic progress or signs from the government, which has promised to do whatever it takes to protect its national interests.