Nokia Shares Sink 7.5% as Firm Comments on Up to $364 Million Damage from Tariffs and Weak Dollar

HELSINKI, Finland—July 23, 2025: By about 7.5% on the Helsinki Stock Exchange, shares of Nokia went down after the Finnish telecommunication equipment maker reduced its profit guidance for the entire year, citing U.S. tariffs and a weak U.S. dollar. The tariff on the company’s operation may cost Nokia up to €310 million (approximately $364 million) in comparable operating profit for 2025 due to tariff and exchange-related hits.

Lowered Profit Outlook

Nokia lowered its forecast for 2025 comparable operating profit, which it now expects to be between €1.6 billion and €2.1 billion, substantially lower than the previous guidance of €1.9 to €2.4 billion. This downward revision came ahead of the company’s unaudited second-quarter earnings announcement, due on July 24, 2025.

For the company, foreign exchange fluctuations, especially the depreciating U.S. dollar, are expected to harm its full-year operating profit by approximately €230 million. Apart from that, current tariffs are expected to further pressure profitability by €50 to €80 million.

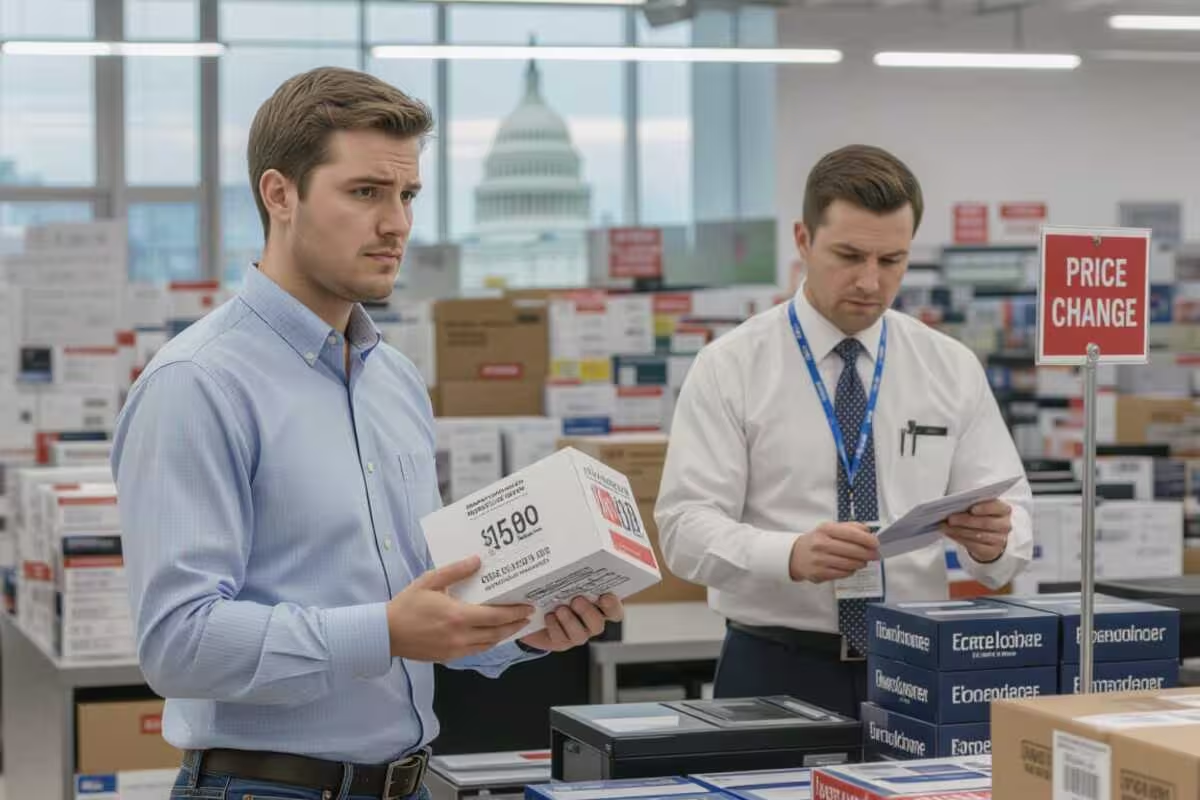

Impact of Tariffs and Currency Headwinds

According to President Donald Trump’s government, the U.S. government has meted out a very basic 10 percent tariff on virtually all imports, issuing occasional threats to further increase duties on products coming in from the European Union. Nokia is, however, operating in both U.S. and Chinese markets, meaning these tariffs hit gravely on the supply chain and cost side, particularly since most manufacturing is done far from the shores of the U.S.

Worsening the financial pain inflicted on arbitrary European companies like Nokia that conduct substantively important business in North America is a depreciating U.S. dollar. A weaker dollar means less turnover when translated back to euros and makes euro-denominated outbound shipments to the U.S. market costlier, hence squeezing profits.

Preliminary Q2 Results and Market Reaction

A preliminary outlook for the second quarter shows net sales at about €4.55 billion and a comparable operating profit of about €300 million. In fact, net sales are up over last year by a paltry 2 percent, and operating profit is expected to fall from €423 million the previous year. According to UBS analysts, Nokia’s new guidance midpoint is 10% below consensus; the preliminary Q2 operating profit is a 26% miss on market expectations.

The cautioning comes following similar alerts from peer Ericsson just last week, which was itself roiled by currency and tariff pressures. News from the Finland-based firm sent 3 million shares away from investors who had other expectations; stocks headed for their worst day since April 2024 were on the radar if the losses held.

Investors were reacting to the company’s caution that, despite maintaining its free cash flow conversion target, however, heading toward the upper end of its full-year guidance will become increasingly difficult.

Company’s Strategy Amid Challenges

“In talking about external headwinds outside its control,” said Nokia’s Chief Executive Officer Justin Hotard, who took office in April. Garcia said previously in April that she would “absolutely entertain” an increase of manufacturing in the U.S. to alleviate some of the tariff impact. The firm will also be flexible enough within its global manufacturing infrastructure not to disrupt too much.

Notwithstanding these external hurdles, Nokia did reaffirm that the underlying business did as expected through the first half of the year. The pattern will be expanded in greater detail in the full disclosures of Q2 earnings tomorrow, including performances in sectors like private 5G networks, which have built good momentum.