SBI Report: Trump Tariffs Hit the US Economy Hard

NEW DELHI, India – August 27, 2025: The State Bank of India (SBI) just put out a report saying that the US’s recent big tariffs on goods from India could really hurt the American economy. The report figures that these new tariffs, which jack up taxes on many Indian products to as high as 50%, might cut down US GDP by almost half a percent and make inflation worse. Basically, American buyers and businesses end up paying more. The report says this move could bring back inflation, especially for stuff like electronics, cars, and home goods.

What the Numbers Say

SBI’s research dropped today, and it’s not pretty. They’re saying these protectionist trade moves by the US could backfire. The report says straight up that the tariffs are slowing down the American economy and cranking up inflation. That’s a big deal because it messes with the idea that these tariffs are good for the US.

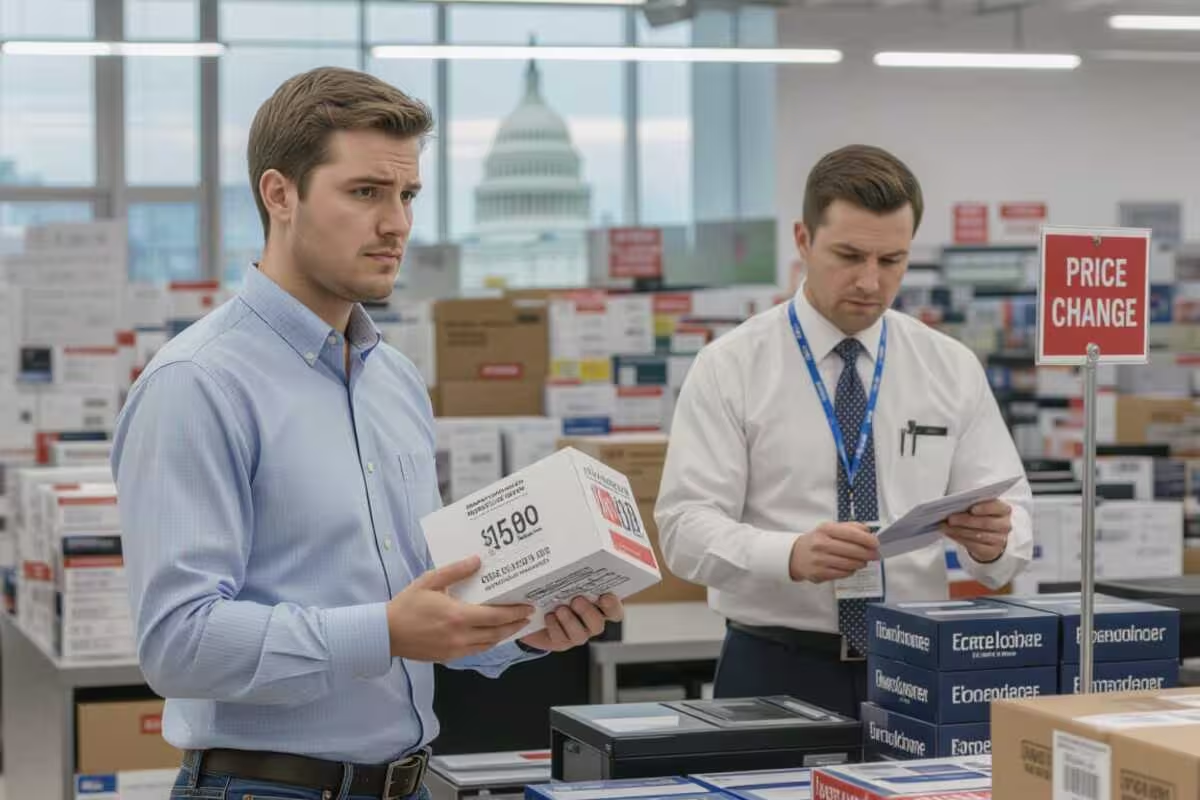

The report says the tariffs are like a punch to the gut, making imported stuff cost more, which makes all prices go up. While US importers might eat some of the cost at first, most of it will land on American families. They think US inflation could stay above the Federal Reserve’s 2% target all through 2026 because of these tariffs and how money is moving around.

Why the Tariffs?

These tariffs kicked in today, slapping an extra 25% tax on top of the existing 25% one. The US government, through Homeland Security, is saying these new taxes are because India keeps buying oil and military gear from Russia. So, it’s not just about money this time; it’s a political jab.

The tariffs are aimed at about $45 billion of Indian exports, but some say it could be more like $60 billion. Things like clothes, jewelry, seafood, and furniture are getting hit hard with this 50% tax. These industries employ a lot of people, so they’re going to feel it the most.

How It Hurts Americans

The SBI report is saying what other financial groups, like Goldman Sachs, have already said: Americans are going to pay more. Some companies might take the hit at first, but these higher taxes will make them raise prices on everything from household goods to parts for factories. That means regular families won’t be able to buy as much.

US industries that rely on imports, like electronics and cars, are already feeling the squeeze. The tariffs on parts and materials from India mess up supply chains and force companies to find different options that might be more expensive or not as good. This switch-up could mess things up and raise transportation costs, making inflation even worse.

Uneven Playing Field

SBI is pointing out that the US is taxing different countries differently. They’ve cranked up tariffs on Indian goods to 50%, but the tariffs on Chinese products are 30%, Vietnamese at 20%, Indonesian at 19%, and Japanese at 15%. This unfairness makes the move against India seem personal, tied to the Russia situation.

Because of these tariffs, other countries that don’t have such high taxes might get an edge. Indian export industries, which have been doing well in the US, are now at a big disadvantage. American importers might start buying from places like Vietnam, Bangladesh, and Mexico instead, which could mess up the US’s own supply chain in the long run.

India’s Response

The Indian government is standing its ground, saying they can make their own choices about foreign policy and trade. Foreign Minister S. Jaishankar has defended India’s oil deals with Russia and said it’s not fair that the US is singling them out when China buys even more Russian oil but isn’t getting the same tariffs. Indian officials are saying they’ll keep talking trade, but there’s no hope for things to ease up or the tariffs to be delayed.

To deal with the economic hit, the Indian government is supposedly getting ready to help exporters and try to sell to new markets in Latin America, the Middle East, and Asia. They’re also talking about fixing up things at home, like simplifying the Goods and Services Tax (GST), to get people to spend more and protect the economy from outside problems.

Big Picture

The SBI report isn’t just about trade; it’s about the whole economy. The US GDP could drop by almost half a percent, which could affect jobs and investments. Economists have been saying for a while that protectionist policies can hurt the country they’re supposed to help, and this report is more proof of that.

This mess has also stirred up the political pot in the US. Critics are saying the tariffs are backfiring, hurting Americans and businesses without reaching the political goals they’re supposed to. The numbers from the SBI report will probably be used to show how these protectionist moves are causing problems.

India’s GST Change: New Tax Slabs & 40% Rate

Looking Back and Ahead

This trade fight is like the ones we saw before, but now the stakes are higher because of the Russia situation. Focusing on one country and its choices adds a new twist. SBI says that while trade talks might fix things eventually, the immediate hit is going to be rough for both Indian exporters and American buyers.

What happens next is unclear. The tariffs could permanently change how global supply chains work. While India is trying to soften the blow, the US economy is facing higher inflation and slower growth because of a policy meant to put pressure on a key partner. The next few months will show how bad the tariffs really are for both economies and what the US will do with its trade policy going forward.